Tourist In Your Own City: Encouraging Locals To Discover The Wow On Their Doorstep

Demand for domestic tourism is on the rise, creating a unique opportunity for tour operators to inspire people to discover the wow on their own doorstep.

In the past year, worldwide Google searches for “local tours near me” hit an all-time high, increasing by 2,238%.[1] Rising travel costs are driving the shift, with airfares increasing by 29% in December alone [2], 91% of Brits say they’re more likely to consider trips in their own city.*

The rising cost of travel, growing awareness of environmental factors and support for local businesses reflect a clear opportunity for experience providers to capitalise on local demand, increase bookings and drive economic growth.

Therefore, understanding what types of tours appeal to locals, the barriers they face, and what motivates them to book is key.

To help local tour operators maximise demand and increase bookings, we at Bókun, a Tripadvisor company, conducted a study into the state of domestic tourism. The research revealed the most and least explored UK cities by locals, as well as undiscovered landmarks, untapped experiences, and key barriers to local tourism.

Mapped potential: Nottingham, Southampton and Manchester rank the top 3 least explored cities by locals

We surveyed 2,000 nationally representative respondents across 17 UK cities to uncover how many people have visited “the top 5” tourist locations in their own city, ranking them from the least to most explored cities by locals. This data highlights where tour operators can capitalise on untapped potential for local tours and experiences across the country.

Nottingham – Only 27% of locals have visited the top 5 attractions

Nottingham tops the list as the UK city least explored by locals. On average, only 27% of residents have visited the five main attractions: 14% have visited Nottingham Castle, 20% The National Justice Museum, just over a quarter (26%) The City of Caves, a third have been to The Ye Olde Trip to Jerusalem, and 42% to Wollaton Hall & Deer Park.

Southampton – 30%

Followed closely by Southampton, the city sees only 30% of locals visiting the top five attractions. 16% have visited The Solent Sky Museum, 19% Tudor House & Garden, a quarter (25%) have been to The SeaCity Museum, and 44% have visited Mayflower Park and The Southampton City Walls.

Manchester – 34%

Manchester rounds out the top three, with an average of 34% of locals visiting the city’s main attractions. 18% have visited The John Rylands Library, 27% have visited the National Football Museum, a third (33%) have visited The Etihad Stadium, 41% have visited The Science and Industry Museum, and half (50%) have visited Old Trafford.

Brighton, Cardiff and Edinburgh revealed as the top 3 most explored cities by locals

Cardiff – 58% of locals visited the top 5 attractions

Cardiff is one of the most explored cities, with 58% of locals having visited the top five attractions. 50% have visited The National Museum Cardiff, 56% have visited The Principality Stadium, 56% have visited St Fagans National Museum of History, 60% have visited Cardiff Castle, and 67% have visited Cardiff Bay.

Brighton – 58%

Brighton matches Cardiff, with 58% of locals exploring the top attractions. 23% have visited The British Airways i360, 53% have visited The Royal Pavilion, 66% have visited The Lanes, 71% have visited Brighton Pier, and 76% have visited Brighton Beach & Waterfront.

Edinburgh – 57%

Edinburgh completes the top three, with 57% of locals having visited the city’s main attractions. 29% have visited The Palace of Holyroodhouse, 59% have visited Arthur’s Seat, 60% have visited The National Museum of Scotland, 64% have visited The Royal Mile, and 72% have visited Edinburgh Castle.

London – 53%

Even in the capital, just over half of locals (53%) have visited the top five attractions. Only 39% have visited Westminster Abbey, 43% have visited St Paul’s Cathedral, 50% have visited Buckingham Palace, 65% have visited The London Eye, and 66% have visited The Tower of London.

| The UK’s least to most explored cities by locals | ||

| #Rank | City | % of locals who’ve visited top 5 tourist attractions |

| 1 | Nottingham | 27.0% |

| 2 | Southampton | 29.6% |

| 3 | Manchester | 33.8% |

| 4 | Birmingham | 34.2% |

| 5 | Norwich | 36.6% |

| 6 | Newcastle | 37.0% |

| 7 | Liverpool | 38.2% |

| 8 | Sheffield | 40.2% |

| 9 | Leeds | 41.4% |

| 10 | Glasgow | 41.8% |

| 11 | Bristol | 42.2% |

| 12 | Belfast | 43.8% |

| 13 | Plymouth | 51.0% |

| 14 | London | 52.6% |

| 15 | Edinburgh | 56.8% |

| 16 | Brighton | 57.8% |

| 17 | Cardiff | 57.8% |

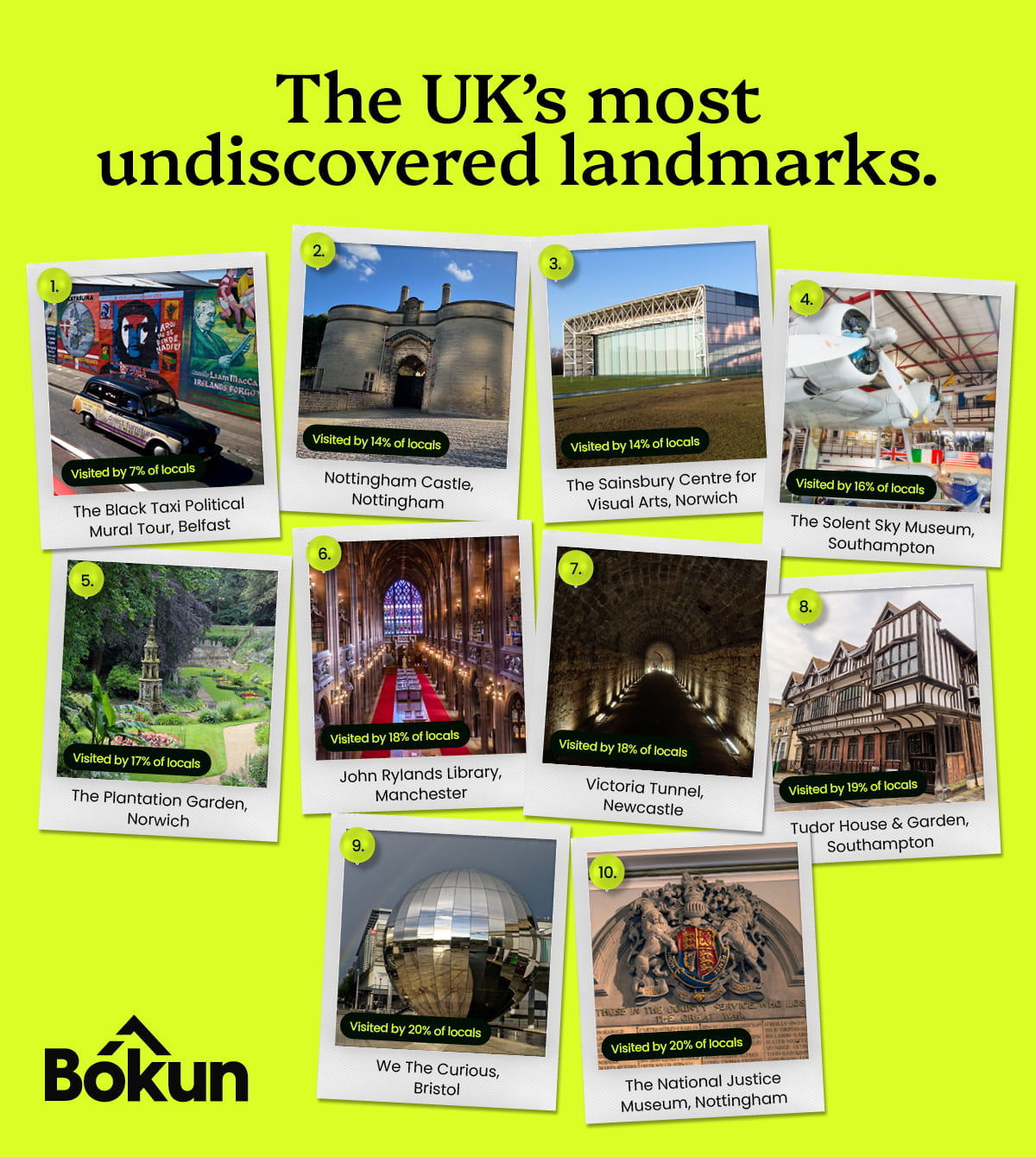

The UK’s most undiscovered landmarks

Even in UK cities celebrated for their history, culture and iconic attractions, the study found that many landmarks are overlooked by the people who live closest to them. The research reveals the UK’s top 10 most undiscovered local landmarks, with fewer than one in five local residents having ever visited each one.

Topping the list is The Black Taxi Political Mural Tour in Belfast, with just 7% of locals having experienced it. This is followed by Nottingham Castle & The Robin Hood Museum (14%) and The Sainsbury Centre for Visual Arts in Norwich (14%), concluding the top three most undiscovered landmarks.

The remaining top 10 includes The Solent Sky Museum in Southampton (16%), The Plantation Garden in Norwich (17%), John Rylands Library in Manchester (18%), Victoria Tunnel in Newcastle (18%), Tudor House & Garden in Southampton (19%), We The Curious in Bristol (20%) and The National Justice Museum in Nottingham (20%).

This data highlights huge untapped potential for tour operators to engage locals with experiences that bring these undiscovered landmarks to life.

The biggest barriers to local tourism: Awareness, perception and weather

While rising travel costs emerged as one of the key drivers of the rise of local tourism, understanding the barriers, including weather, awareness and accessibility, is key for tour operators to adapt existing experiences and drive demand for local tours.

Surveying 2,000 nationwide respondents on their awareness, attitudes and experiences of local tours and experiences in their own city, highlighted key insights into Britain’s biggest barriers to local tourism.

The gap between interest and access

The study identified awareness as one of the biggest barriers, with a staggering 81% of respondents saying they are unaware of the tours and experiences available on their doorstep.

Perception also plays a role, with more than a quarter (28%) admitting they associate tours with tourists rather than locals. In fact, 22% said they want experiences designed specifically for locals.

21% of respondents said they are interested in local tours and experiences, but don’t know where to find them – revealing a clear gap between interest and access, and highlighting that demand exists, but discoverability remains a key obstacle.

Weather and seasonality

The research also found that weather plays a significant role in limiting local tourism in the UK, with one in six respondents (15%) admitting they are put off by weather or seasonal conditions.

Looking at specific tours and experiences, over a quarter (27%) say they are unlikely to book a walking tour during winter, while 22% are less inclined to choose outdoor or nature-based experiences in autumn or winter. More broadly, 27% actively consider weather or seasonality before making a booking.

The data shows seasonality also influences appeal, with 23% of respondents saying walking tours only interest them in warmer months. In contrast, food and drink experiences show year-round appeal, attracting 27% of respondents regardless of season.

Interestingly, more than a quarter (27%) of respondents said they would book more if experiences were available outside peak tourist season – highlighting a key opportunity for tour operators to capitalise and adapt tours to appeal all year-round.

Samuel Jefferies, Senior Growth Marketing Manager at Bókun, has provided three ways TO’s can bridge the barriers between awareness, perception and weather.

“Beyond economic pressures, it’s clear that awareness, perception and weather play a key role in shaping how locals engage with tours and experiences in their own cities. However, the research also reveals clear opportunities for tour operators to boost bookings and drive demand for local tourism.”

Incorporate geographical keywords to boost awareness

“To bridge the gap between interest and access, tour operators can make local experiences easier to discover by improving online visibility. Meta titles and descriptions should clearly reflect the city, town, or landmark – using relevant, geographically focused keywords to help tours appear in “near me” searches and reach local audiences more effectively. These keywords not only improve search engine visibility but also allow AI chatbots and itinerary-planning tools to recommend experiences to interested consumers, ensuring residents can easily find and book what’s on their doorstep.”

Provide local-first messaging

“Adopting a local-first approach is key to shifting perception, framing experiences as designed for residents rather than tourists. Tour operators can reinforce this by highlighting hidden gems, local stories and creating tours rooted in the city’s culture. Partnering with local businesses makes tours feel authentic – for example, a city walking tour could include a stop at a family-owned bakery. These collaborations not only enhance the experience and appeal for locals, they directly benefit local businesses.”

Weather-proof tours to develop year-round strategies

“By offering weather-proof alternatives, tour operators can develop year-round strategies. Indoor or sheltered options, flexible “Plan B” itineraries, and diversified seasonal offerings ensure tours remain operational in all conditions. Attention to detail – such as providing umbrellas, rain ponchos, or warm refreshments – can enhance comfort and encourage year-round interest.

“Sharing real-time updates about weather-related changes builds trust and helps residents engage with local experiences year-round, turning potential barriers into opportunities for increased bookings and economic impact.”

From walking tours to cooking classes: The most untapped local experiences

In an ever-changing landscape influenced by cultural trends, social media, technology, and seasonal factors, understanding local demand for tours and experiences is key to boosting tourism. Therefore, our study set out to find the most tours and experiences with the most untapped potential.

History, cultural, and museum tours top the list, appealing to almost two-fifths of respondents (38%), closely followed by walking and sightseeing tours (33%) and local food experiences (25%).

Outdoor and nature-based activities (23%) and attractions such as theme parks (21%) also draw interest, alongside a smaller but growing demand for local drinking tours (17%) and hands-on workshops or classes (12%).

These findings reveal clear opportunities for operators to tailor experiences to locals’ interests, focusing on culture, history, and walking tours while diversifying offerings with food, nature, and hands-on activities to engage a wider audience.

Flexibility, added value and would make locals book onto tours in their own city

Search demand for “flexible tours” has surged by over 1,222% in the past year – highlighting a growing demand for experiences that fit around busy, working lifestyles.3 Our research mirrors this shift, with almost a third (32%) of respondents saying flexible bookings – including free cancellation or easy changes – would make them more likely to book tours and experiences in their own city.

Added value also plays a key role in driving demand, with 31% more likely to book when experiences include a free drink, food, discounts or bundled offerings. Other motivations included:

- 23% want clear, real-time information (timings, meeting points and updates)

- 22% want experiences designed specifically for locals

- 17% say accessibility features would encourage them to book

Samuel Jefferies, Senior Growth Marketing Manager at Bókun, comments:

“For tour operators, this is a clear opportunity to rethink how experiences are packaged and offered. Simple additions such as free cancellation, bundled extras or discounts on other local experiences can significantly increase bookings.

“Adapting offerings and introducing tailored add-ons – including locals-only tours – can help drive demand and support year-round bookings, particularly as 27% of respondents say they would book more if experiences were available outside peak tourist season. Partnering with local experience providers, such as independent makers, food and drink venues or cultural organisations, can also enhance the experience while boosting awareness and visibility.

“Finally, implementing a streamlined, well-connected booking system can enable operators to deliver clear, real-time updates, building trust and authority with customers, while removing hours wasted on admin.”