In a world that never stops moving, a new tourism trend has taken centre stage: quiet travel. Driven by a population with a growing desire to switch off from the hustle and bustle of busy daily life, wellness and relaxation retreats have become the latest hot commodity. Particularly among young people, travel priorities are shifting towards a desire for downtime or, as Bókun has coined it, “Quiet Travel”.

Through analysis of current and forecasted search trends, combined with countries’ decibel data, and seasonality in travel, Bókun’s “Quiet Travel” campaign explores how tourism demands have evolved over the last ten years and how interest in destinations and tours is predicted to change.

THE RISING POPULARITY OF SOLO TRIPS

Tours and trips have always been integral to the holiday experience. However, our analysis shows that travel trends are undergoing significant transformations, with health and wellness appearing at the forefront.

Analysis of Google searches found that interest in “Bali wellness retreats” has skyrocketed by 2956% over a ten-year period, highlighting a growing appreciation for relaxation and rejuvenation as central aspects of travel. Simultaneously, “bird-watching tours” have surged by 343%, “walking tours” have grown by 101%, and there has been a 177% rise in searches for “geothermal spas”, reflecting consumers’ growing desire to reconnect with calming nature in varied ways. Tourists are also shifting toward a need for alone time, with searches for “solo travel” increasing by 324%, and “solo holiday” rising by 63%. This trend is also gaining more dominance on social media, with #SoloTravel having more than 948,000 posts on TikTok.

Top trips according to search demand over the last ten years:

| Trip Demand | Search Demand (Over Past 10 Years) |

| Bali Wellness Retreat | 2956% |

| Wellness Retreat | 470% |

| Bird Watching Tour | 343% |

| Solo Travel | 324% |

| Nature Retreat | 282% |

| Quietest Beach | 138% |

| Walking Tour | 101% |

| Hiking Tour | 101% |

| Botanical Garden | 80% |

| Solo Holiday | 63% |

WHERE PEACE MEETS POPULARITY: THE MOST IN-DEMAND QUIET TRAVEL DESTINATIONS

A decade-long analysis of search interest reveals surprising trends in holiday demand, with destinations like Macedonia experiencing an astounding 183% increase. Similarly, The Netherlands and Luxembourg have seen significant growth, with increases of 133% and 93%, respectively.

When analysing what all these countries have in common, it is evident they are renowned for their quiet and relaxing nature. Macedonia offers serene lakes like Lake Ohrid; the Netherlands has beautiful national parks like Hoge Veluwe; Luxembourg, known as “Little Switzerland,” boasts the scenic Mullerthal Region; and Lithuania is famous for its wellness treatments in spa towns like Druskininkai and the serene Curonian Spit.

Interestingly, this surge in tourist interest appears to be closely associated with a preference for quieter, less noise-polluted destinations. Countries like The Netherlands (+133%), Denmark (+53%), Finland (+37%), and Latvia (+36%) are among the least noise-polluted in Europe, reflecting a growing consumer desire for tranquillity.

This shift highlights a broader trend where travellers are increasingly seeking serene and peaceful environments, highlighting a potential area of focus for tour operators and destination marketers aiming to cater to this evolving preference.

TRENDS IN TRAVEL: LET’S TALK SEASONALITY

Mastering the knowledge of peak seasons and booking spikes allows tour operators to anticipate demand, strategically manage inventory, allocate resources efficiently, and tailor marketing strategies to their target audience during peak interest periods.

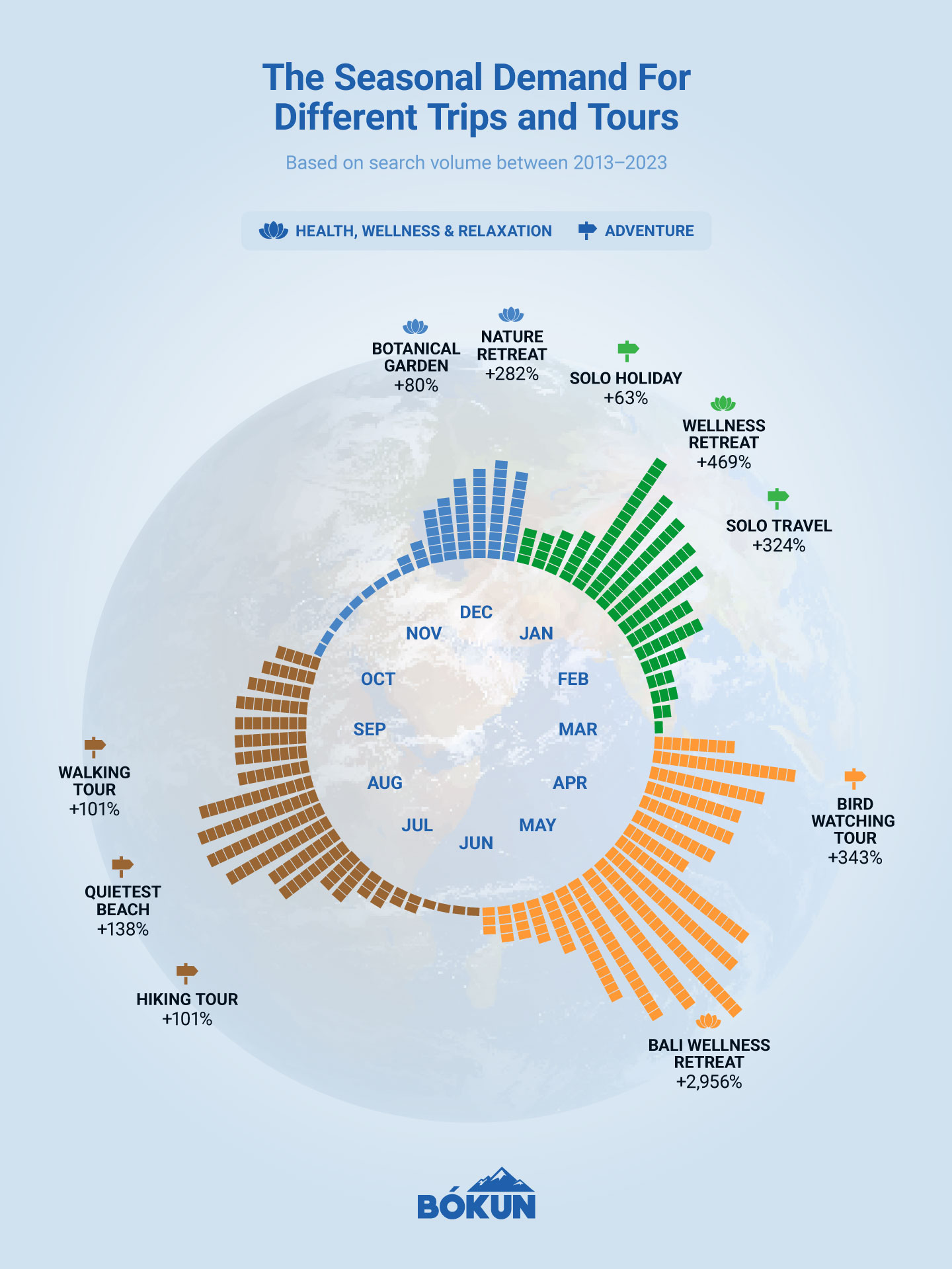

Our analysis found that searches for wellness retreats, solo holidays, and solo travel peak during December, January, and February, likely driven by a desire for new beginnings as people enter the new year. Interestingly, interest in Bali wellness retreats and bird-watching tours spikes during April and May, perhaps due to the ideal weather conditions and unique wildlife activities available during this period.

As the year progresses, there is a noticeable shift with tourists showing an increased interest in walking tours, quiet beaches and hiking tours during the late summer months of August and September. Meanwhile botanical gardens and nature retreats see a surge in popularity from September through to December.

June and July are the quietest months for searches related to quieter travel, possibly because many travellers are already on holiday, reducing the need for further getaway planning. Understanding seasonality patterns is crucial when marketing tours and holidays, ensuring you capture the attention of potential travellers at the most opportune times.

THE FUTURE FORECASTED: THE YEAR OF ADVENTURE AND WELLNESS

By analysing data projections for 2025, we can see significant growth is anticipated in the following European countries:

| Rank | Country | Predicted search increase (2025) |

| 1 | The Netherlands | 32% increase |

| 2 | Latvia | 8% increase |

| 3 | Finland | 4% increase |

| 4 | Bulgaria | 4% increase |

| 5 | Iceland | 1% increase |

The Netherlands: A staggering 32% increase in search interest is predicted for 2025. Famous for its picturesque canals, tulip fields and more progressive culture, it seems that travellers may be keen to embrace more of the laid back style of the country, opting for cycling in the countryside over partying around the red light district.

Other countries projected to see an increase in search interest for the year ahead include Latvia (8% increase), Finland and Bulgaria (4% increase) and Iceland (1% increase).

Despite the clear surge in demand for quieter destinations, some noisier countries are also forecasted to gain popularity, with Luxembourg (11% increase), Switzerland (9% increase), and Belgium (5% increase) among these.

These trends highlight a future strategy for tour operators who may consider striking the perfect balance between vibrant city experiences and peaceful getaways.

THE YEAR OF THE GLAMPER: BREAKOUT TRAVEL TRENDS FOR 2025

2024 has already seen a notable shift towards quiet and wellness-oriented travel, and data shows that this trend is predicted to continue well into 2025. Our in-depth analysis has identified several travel activities and tours that are set to become increasingly popular:

| Rank | Tours and activity searches | Predicted search increase (2025) |

| 1 | “Nature Retreats” | 23% increase |

| 2 | “Hiking Tours” | 19% increase |

| 3 | “Walking Tours” | 17% increase |

| 4 | “Historical Landmarks” | 15% increase |

| 5 | “Wellness Retreat” | 14% increase |

Whether it’s glamping under the stars or staying in eco-friendly lodges, 2025 could be the year of the glamper, with interest in “nature retreats” forecasted to be the most popular (23%+). Hiking (19%+) and walking tours (17%+) are also predicted to be increasingly sought after as tourists look for a more intimate way to discover cities, towns, and rural areas, with an emphasis on appreciating surroundings and combining exercise with exploration.

Our findings explain why tour operators must recognise diversity within the travel market. While quiet travel is on the rise, there remain tourists who crave different experiences. By strategically diversifying tour offerings, operators can adapt to trends and cater to a wide range of traveller preferences, ensuring they meet the demands of both new and existing holidaymakers.

Methodology

By utilising Google Search Trend data, we compared the total searches in 2013 with those in 2023. This comparison allowed us to identify significant rises in search interest over the decade. We then calculated the percentage difference between the two years to quantify these changes.

By utilising Glimpse, we were able to calculate the seasonality of searches in each location. In addition, the forecasting tool was used to predict the percentage increase in search trends for 2025.

The European Topic Centre on Air Pollution, Transport, Noise, and Industrial Pollution’s report on population exposure to noise from various sources, allowed us to calculate the average percentage of the population exposed to different noise levels across air, road, and rail pollution. It is important to note that data was not available for each country and region, thus the figures represent an average metric based on the available data.